Audit Assertions for Purchases

Audit assertions for investments. All businesses make assertions in their financial statements.

Audit Expenses Meaning Audit Assertions Risks Substantive Procedures Carunway

Understand the entity and its environment.

. When auditing cycles for different companies the typical approach is to. Internal control pertaining to the occurrence. I Occurrence the.

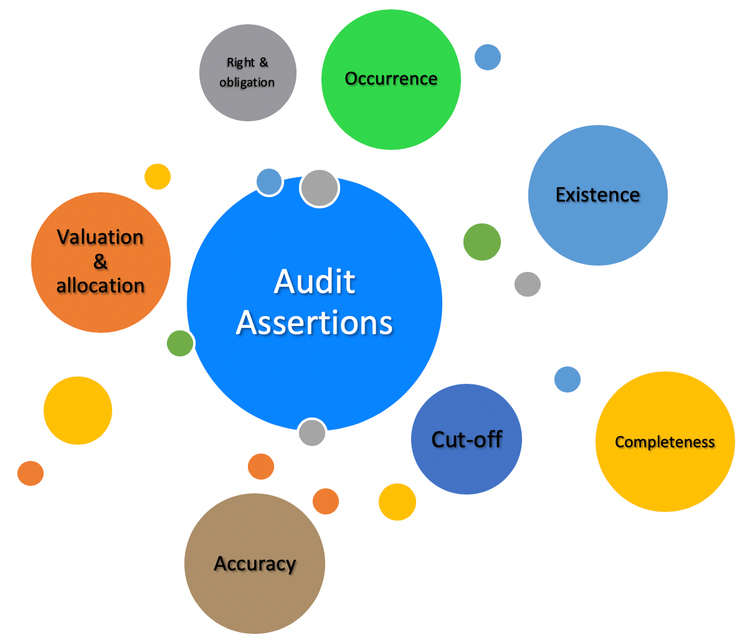

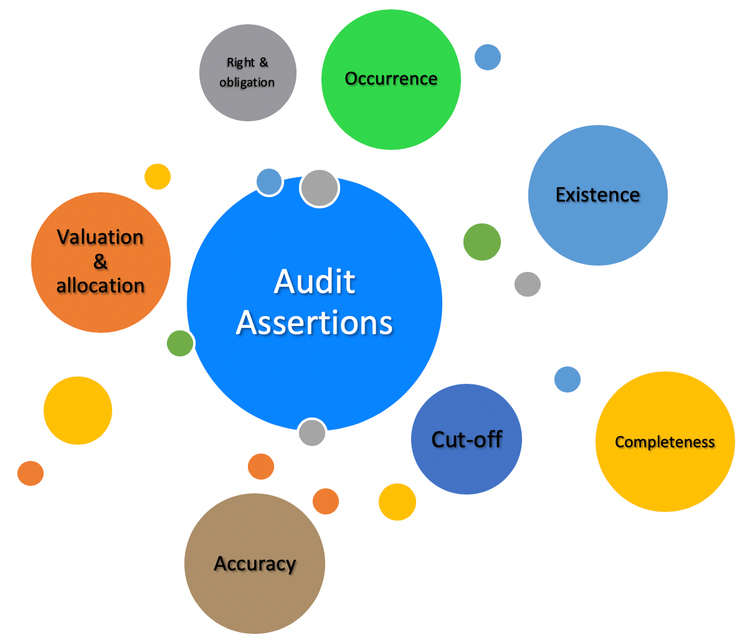

There are four major auditing assertions that need to be tested during an audit process. Unqualified Audit Opinion Ar. Assertions about classes of transactions and events and related disclosures for the period under audit.

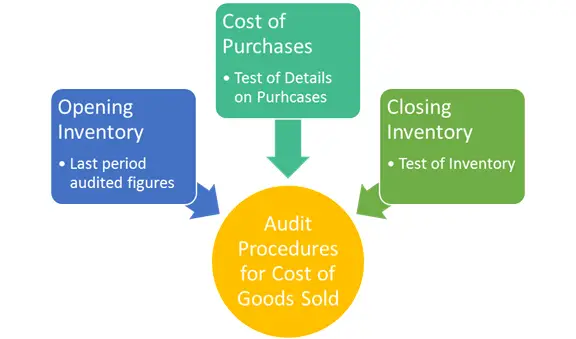

The first step is to make a Purchase order or requisition and the demand for the ordering of goods should come from the respective department in. Therefore all these 3 different line items need to be. During your audit you need to test management financial statement assertions for fixed and intangible asset transactions.

As auditors we usually audit inventory by testing the various audit assertions including existence completeness rights and obligations and valuation. In the audit process of inventory physical. Study Assertions for Purchasing and Cash Disbursement flashcards from Kathy Shelledys Nova Southeastern University class online or in Brainscape s iPhone.

I Occurrence the. Audit procedures are relevant to gathering. Audit of expenses can be done by testing various audit assertions of completeness accuracy occurrence and cut-off.

Audit Assertions for Expenses. The assertions listed in ISA 315 Revised 2019 are as follows. Vouch new purchases and disposals of.

Cost of Goods Sold is computed using the following formula. Accounts Payable is an obligation that is incurred on companies in terms of. What are the Assertions in the Audit of Financial Statements.

The assertions listed in ISA 315 Revised 2019 are as follows. Assertions about classes of transactions and events and related disclosures for the period under audit. For example auditors may check to ensure that the client hasnt posted purchases to salaries and wages accounts.

Investments reported on the financial statements really exists at the reporting date. Cost of Goods Sold Opening Inventory Purchases Closing Inventory. The six assertions that you must attend to when.

For example when a financial statement has a cash balance of 605432 the business asserts that the cash exists.

Auditing Cost Of Goods Sold Risks Assertions And Procedures Audithow

Understanding Audit Assertions A Small Business Guide

Audit Procedures Types Assertions Accountinguide

Audit Expenses Assertions Risks And Procedures Wikiaccounting

No comments for "Audit Assertions for Purchases"

Post a Comment